Ongole Municipal Corporation is a city situated in the Prakasam district of the state of Andhra Pradesh. The Municipal Corporation of Ongole was established in the year 1876 and was upgraded on 25th January 2012. The city of Ongole is one of the thirteen municipal corporations of the state of Andhra Pradesh. It is headquartered in Ongole Mandal. Ongole City is the 13th largest city in the state of Andhra Pradesh based on population. It is located in the eastern part of the Prakasam district. In the city of Ongole to pay property tax you need visit to the office of the local body / Municipal Corporation.

The Ongole Municipal Corporation has a responsibility to collect property tax from all assessed properties covered under its jurisdiction. Property tax is calculated based on such assessments. The total number of inhabitants in the city is two lakhs two thousand eight hundred twenty-six out of which one lakhs three thousand five hundred forty-one are males and one lakhs two thousand eight hundred seventy-eight are females. Here check all the details about how to pay property tax in Ongole MC and check your house tax return.

Procedure for Ongole Municipal Corporation Property Tax Payment

If you want to pay property tax online in Ongole Municipal Corporation, follow the below procedure:-

- For this, first of all, you have to go to the official website of the Commissioner and Director of Municipal Administration, Government of Andhra Pradesh. The link of which is given below;

Ongole Municipal Corporation => Click here

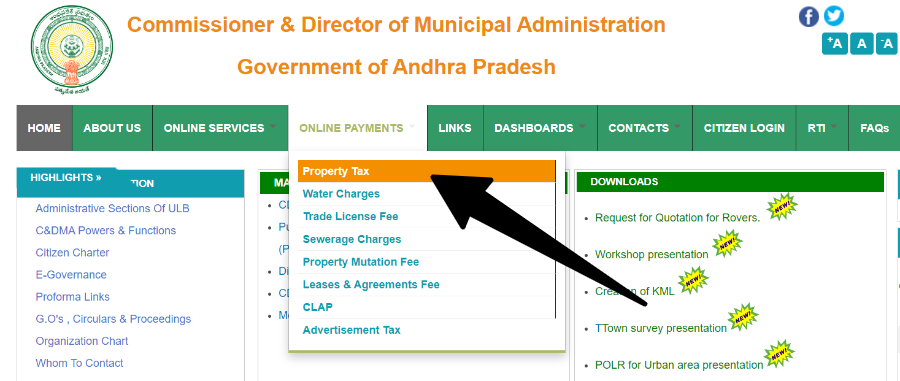

- Now you have to click on the link of “Property Tax” under “Online Payment” on the home page.

- After this, the online payment page will open in front of you.

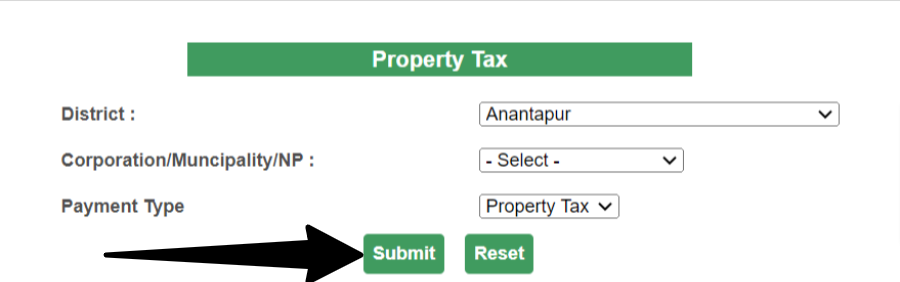

- On this page, you have to select your district, corporation/municipality/NP, and payment type and click on the “Submit” button.

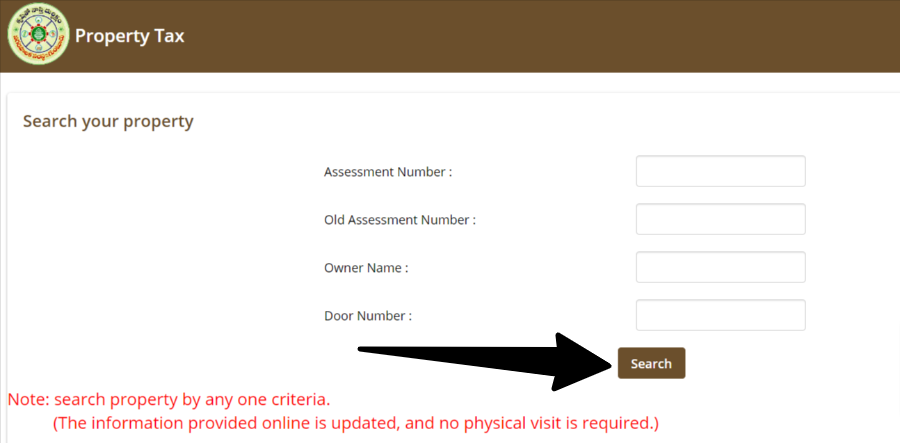

- Now you will reach the “Search Your Property” page. Here you have to enter the assessment number, old assessment number, owner’s name, and door number and click on “Search”.

- After this, the complete details of your property tax will open in front of you. Here you have to pay your tax by clicking on the payment link and choosing one of the payment options.

Steps to Calculate Ongole Municipal Corporation Property Tax Online

If you also want to calculate Ongole Municipal Corporation property tax online, then for this you have to follow some easy steps. These are as follows:-

- For this, first of all, you have to go to the website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh. Below you have been provided its direct link –

Calculation of Property Tax Online => Click Here

- As soon as you click on the link, you will reach the home page of the official website of the Commissioner & Director of Municipal Administration Government of Andhra Pradesh.

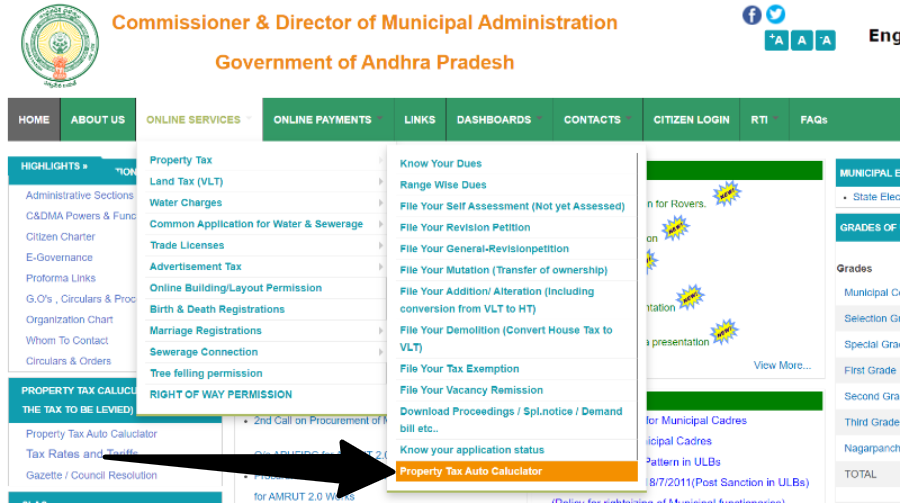

- Here you have to click on Online Service => Property Tax => and then Property Tax Auto Calculator. As shown in the picture below.

After this, the next page will open in front of you where you have to select District, and Corporation/Municipality/NP and click on “Submit”.

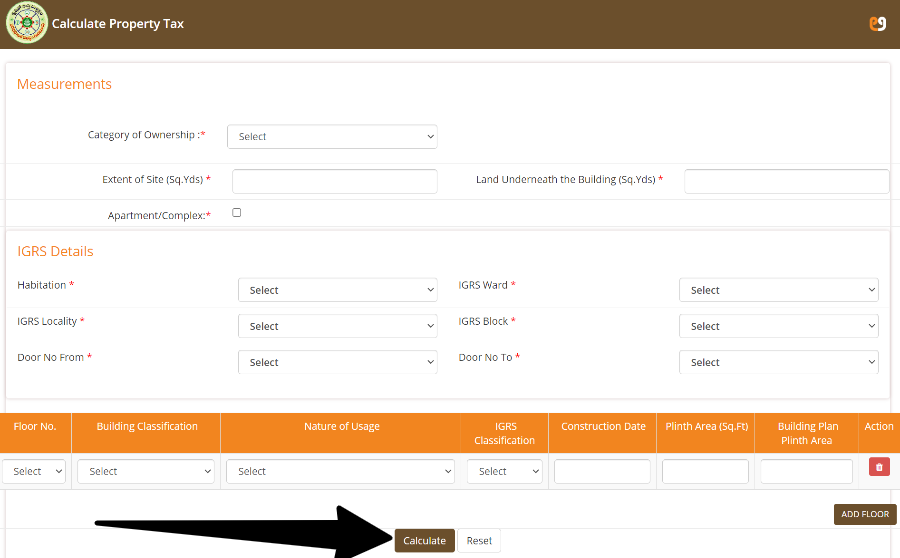

After this, the next page will open in front of you where you have to select District, and Corporation/Municipality/NP and click on “Submit”.- Now a new page will open in front of you. Here you have to fill in all the information asked correctly.

- First of all, information related to Measurements has to be provided.

- After this, details of the Integrated Grievance Redressal System (IGRS) have to be provided.

- Now finally you have to select Floor No., Building Classification, Nature of Usage, IGRS Classification and provide information about Construction Date, Plinth Area (Sq. Ft), and Building Plan Plinth Area.

- After this, finally, you have to click on “Calculate”. In this way, you can easily calculate your property tax online

Ongole Municipal Corporation Contact Details

| Address | Bhagyanagar, Ongole, Andhra Pradesh 523001 |

| Telephone Number | 9849925839 |

Here are the steps for payment of property tax online in Ongole Andhra Pradesh. You need to check all the details before the payment of the property/ house tax.